10 AI Coins I’m Tracking for 70% to 400% Gains This Cycle

These aren’t hype plays. They’re high-conviction setups with structure, volume, and serious upside this cycle.

Good morning future millionaires

AI is more than just a crypto trend. It’s the backbone of a new digital economy, and on-chain AI projects are finally catching momentum again.

We’ve seen this before. The crowd gets distracted, narratives shift, and just when everyone looks away, sectors like AI rotate hard.

Below are the 10 AI coins I’m watching closely for serious upside this cycle. These aren’t low-volume gambles. These are high-conviction trades with structure, volume potential, and a narrative tailwind.

I’ve included projected percentage gains based on prior cycles, market cap expansion, and technical setups.

VAIOT (VAI)

Sector: AI-powered legal and insurance automation

What it does:

VAIOT combines AI with blockchain to create automated legal contracts and virtual services that work in regulated industries. Think of it as natural language contracts powered by smart contracts and machine learning.

Why it matters:

Most AI coins focus on data or compute. VAIOT targets a sector with real-world adoption potential and serious inefficiency. If enterprise integration of AI picks up in legal or insurance tech, this coin is well-positioned.

Cycle target: Projected upside of 280%

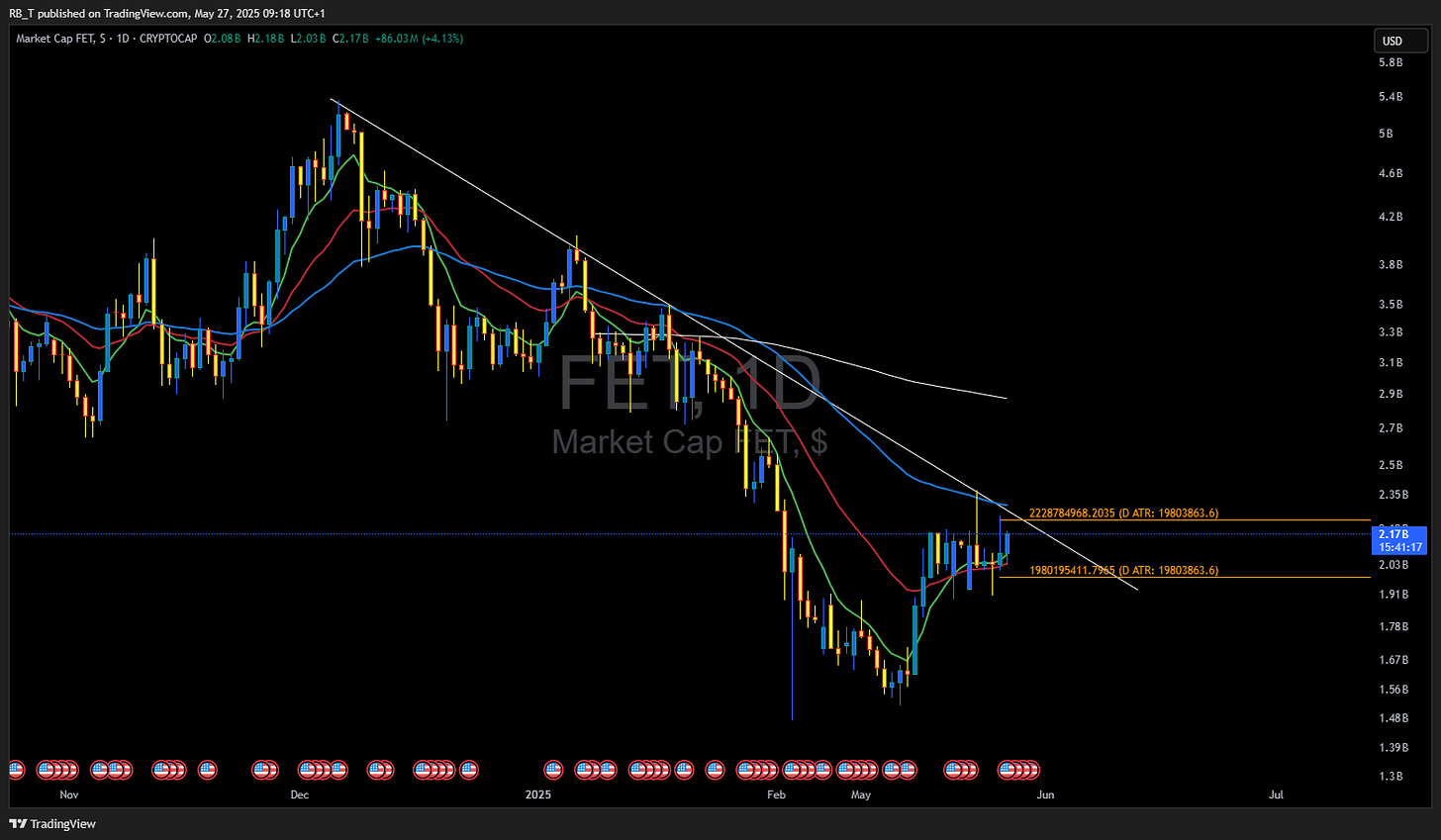

Fetch.ai (FET)

Sector: Autonomous agent networks and decentralized machine learning

What it does:

Fetch.ai builds infrastructure for autonomous agents to transact, learn, and optimize without human input. Use cases include transportation, energy grids, and supply chain management.

Why it matters:

FET is a core piece of the upcoming ASI merger with AGIX and OCEAN. This merge is expected to form one of the largest decentralized AI alliances in crypto. With its solid tech and growing institutional interest, it’s no surprise FET is already moving.

Cycle target: Projected upside of 80%

"In investing, what is comfortable is rarely profitable."

— Robert Arnott

SingularityNET (AGIX)

Sector: Decentralized AI marketplace

What it does:

AGIX lets developers and companies deploy and monetize AI services on-chain. It’s one of the few true open-market AI protocols, with real use cases in medical AI, data classification, and more.

Why it matters:

AGIX is a critical part of the ASI merger, and Dr. Ben Goertzel’s team is highly respected in AI circles. It has a first-mover advantage and has been building through multiple market cycles.

Cycle target: Projected upside of 300%

Ocean Protocol (OCEAN)

Sector: Decentralized data for AI model training

What it does:

Ocean allows tokenized data sharing between parties. It enables AI models to train on large, high-quality datasets while protecting privacy and data ownership.

Why it matters:

AI cannot scale without high-quality data. Ocean is building the foundation for privacy-preserving machine learning. With the ASI merger, Ocean will become one of the most valuable pieces of decentralized AI infrastructure.

Cycle target: Expected to break new highs with projected upside of 300%+

"The trend is your friend until it bends."

— Trader wisdom

Keep reading with a 7-day free trial

Subscribe to Inside the Trade: to keep reading this post and get 7 days of free access to the full post archives.