Ethereum's July Target: $4,050

Why You Should Buy Now and Store Safely | Today's Market Letter | June 2025

The institutional crypto revolution is accelerating, and Ethereum is positioned to be one of the biggest beneficiaries. While the market has been consolidating around the $2,500 level, smart money continues to accumulate on every dip. Our July target of $4,050 represents a 60%+ move from current levels, backed by unprecedented institutional buying and strong technical setup.

The Institutional Accumulation Story

The numbers don't lie when it comes to institutional appetite for Ethereum. BlackRock, the world's largest asset manager, has reportedly purchased 269,000 ETH since May 9, 2025, amounting to $673.4 million. This represents roughly 0.23% of ETH's entire supply, scooped up in just 30 days.

What makes this even more compelling is the timing. These purchases continued even as BlackRock trimmed Bitcoin ETF holdings, suggesting a strategic shift toward Ethereum allocation. Meanwhile, MicroStrategy continues its aggressive accumulation strategy, recently purchasing an additional 245 Bitcoin for $26 million, with both BlackRock and MicroStrategy now in the race to hold 1,000,000 BTC.

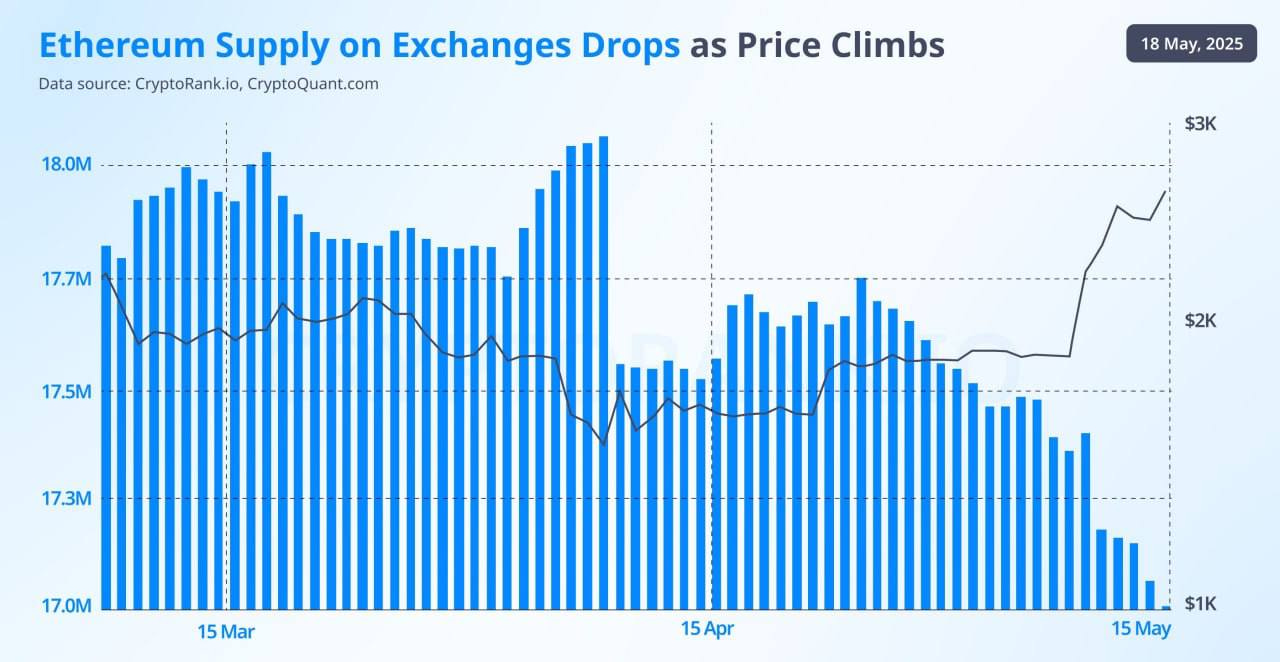

The institutional buying pattern is clear: every significant dip gets absorbed by institutional capital. Institutional interest in ETH ETFs surged recently, with $286M inflows, supporting price stability and a potential rise toward $3,000.

Why $4,050 by July Makes Sense

Our $4,050 target isn't pulled from thin air. Multiple analysis sources converge around similar bullish projections for Ethereum's 2025 trajectory. Expert forecasts see Ethereum hitting an average price of $4,175 for 2025, with some predictions reaching as high as $6,105.

Analysts are optimistic about Ethereum's price trajectory, with some forecasts suggesting Ethereum could reach new all-time highs, potentially exceeding $6,500 in 2025, driven by increased demand and continued network improvements.

The July timeline aligns with several key catalysts:

Regulatory Clarity: The regulatory environment continues to improve, with clearer guidelines emerging for institutional crypto adoption.

ETF Momentum: Ethereum ETF flows are gaining traction, following the successful Bitcoin ETF launches.

Network Upgrades: Continued improvements to Ethereum's scalability and efficiency are driving increased adoption.

Institutional FOMO: As more institutions announce crypto strategies, the remaining holdouts face pressure to allocate.

Current Market Setup

Ethereum is currently trading near $2,522, down by 0.24% intraday, as broader market sentiment remains cautious. This consolidation phase is exactly what we want to see before the next major leg higher.

Ethereum remains volatile and could rise in value to over USD 5,000, depending on market trends and regulatory developments. Key influencing factors include Ethereum ETFs, institutional investments, Layer 2 solutions and technological improvements.

The current price action shows a healthy consolidation after the recent rally. Every pullback has been met with institutional buying, creating a solid foundation for the next move higher.

Smart Money Buying Every Dip

The pattern is unmistakable: every time Ethereum shows weakness, institutional buyers step in. This creates a floor effect that limits downside while setting up explosive moves higher when sentiment shifts.

BlackRock's aggressive accumulation strategy, combined with MicroStrategy's continued buying, signals that sophisticated investors see significant value at current levels. When the world's largest asset manager commits nearly $700 million to Ethereum in just one month, retail investors should pay attention.

Why You Need a Hardware Wallet (And How to Use One)

Before we discuss the opportunity, let's address the elephant in the room: security. If you're buying Ethereum with a $4,050 target, you need to store it properly. Leaving crypto on exchanges is like leaving cash on the counter of a busy restaurant.

What is a Hardware Wallet?

A hardware wallet is a physical device that stores your cryptocurrency private keys offline, away from internet-connected devices that could be hacked. Think of it as a vault for your digital assets.

Why You Absolutely Need One:

Exchange Risk: Exchanges can be hacked, go bankrupt, or freeze your funds. When you control your private keys, you control your crypto.

Insurance: Your crypto is truly yours. No third party can restrict access or freeze your account.

Peace of Mind: Sleep better knowing your investment is secure, especially as it grows toward our $4,050 target.

How to Set Up Your Ledger (Step by Step):

Step 1: Purchase your Ledger device directly from the manufacturer (never buy from third parties).

Step 2: Unbox and connect to your computer via USB.

Step 3: Initialize the device and create a new wallet (never use a pre-configured device).

Step 4: Write down your 24-word recovery phrase on the provided recovery sheet. Store this in a safe place, separate from your device.

Step 5: Install Ledger Live software on your computer.

Step 6: Install the Ethereum app on your Ledger device through Ledger Live.

Step 7: Create an Ethereum account in Ledger Live.

Step 8: Transfer your ETH from the exchange to your Ledger wallet address.

Step 9: Verify the transaction on your Ledger device screen before confirming.

Critical Security Tips:

Never share your recovery phrase with anyone. Store it in a fireproof safe or safety deposit box. Always verify addresses on your device screen before sending. Keep your Ledger Live software updated. Never enter your recovery phrase on any computer or website.

The Risk/Reward Opportunity

At current levels around $2,500, Ethereum offers exceptional risk/reward to our $4,050 target. That's 62% upside potential with institutional backing providing downside protection.

The macro environment supports crypto adoption, with traditional finance finally embracing digital assets as legitimate investment vehicles. Ethereum, as the foundation for DeFi and the broader crypto ecosystem, stands to benefit disproportionately from this institutional adoption wave.

Position Sizing and Strategy

Given the institutional backing and technical setup, this is an opportunity to take a meaningful position in Ethereum for the July run. Dollar-cost averaging on any weakness makes sense, as the institutional bid continues to provide support.

The key is patience and proper storage. Buy spot Ethereum, transfer to your hardware wallet, and let the institutional accumulation drive prices higher over the coming weeks.

Bottom Line

Ethereum at $2,500 with a $4,050 July target represents one of the clearest risk/reward opportunities in crypto today. Institutional money is flooding in on every dip, regulatory clarity continues to improve, and the technical setup supports a major move higher.

Don't let this institutional accumulation phase pass you by. Buy spot Ethereum, store it safely on a hardware wallet, and position for the July breakout. When BlackRock is buying $700 million worth in a month, retail investors should be paying attention.

The next few weeks could determine whether you're positioned for Ethereum's next major leg higher, or watching from the sidelines as institutional money drives prices to new highs.

Risk Disclaimer: Cryptocurrency investments involve substantial risk and volatility. Past performance does not guarantee future results. Always invest only what you can afford to lose.

Affiliate Disclosure: This post may contain affiliate links to hardware wallet providers. We may earn a commission if you purchase through these links, at no additional cost to you. We only recommend products we personally use and trust for securing crypto assets