How $3,500 in Garage Money Became $15.7 Trillion

The 8 Companies That Prove Small Investments Can Create Generational Wealth

Listen up, traders. I'm about to show you the most profitable pattern in market history - one that's created more wealth than oil, gold, and real estate combined. We're talking about 8 companies that started with pocket change and now control over $15 trillion in market capitalization.

This isn't just business history. This is the ultimate case study in asymmetric risk-reward ratios that every serious trader and investor needs to understand.

The Setup: Garage-to-Giant Trade Pattern

AAPL - Apple Inc.

Entry Point (1980 IPO): $22 per share, $1.8B market cap

Current Position: $3.1T market cap (172,000% return)

The Catalyst: Jobs and Wozniak betting their $1,300 savings on personal computing in a Los Altos garage, 1976

Key Insight: They saw the consumer tech revolution 30 years before Wall Street

GOOGL - Alphabet Inc.

Entry Point (2004 IPO): $85 per share, $27B market cap

Current Position: $1.7T market cap (6,200% return)

The Catalyst: Page and Brin's Stanford garage operation in 1998, burning through PhD stipends

Key Insight: They monetized human attention at infinite scale

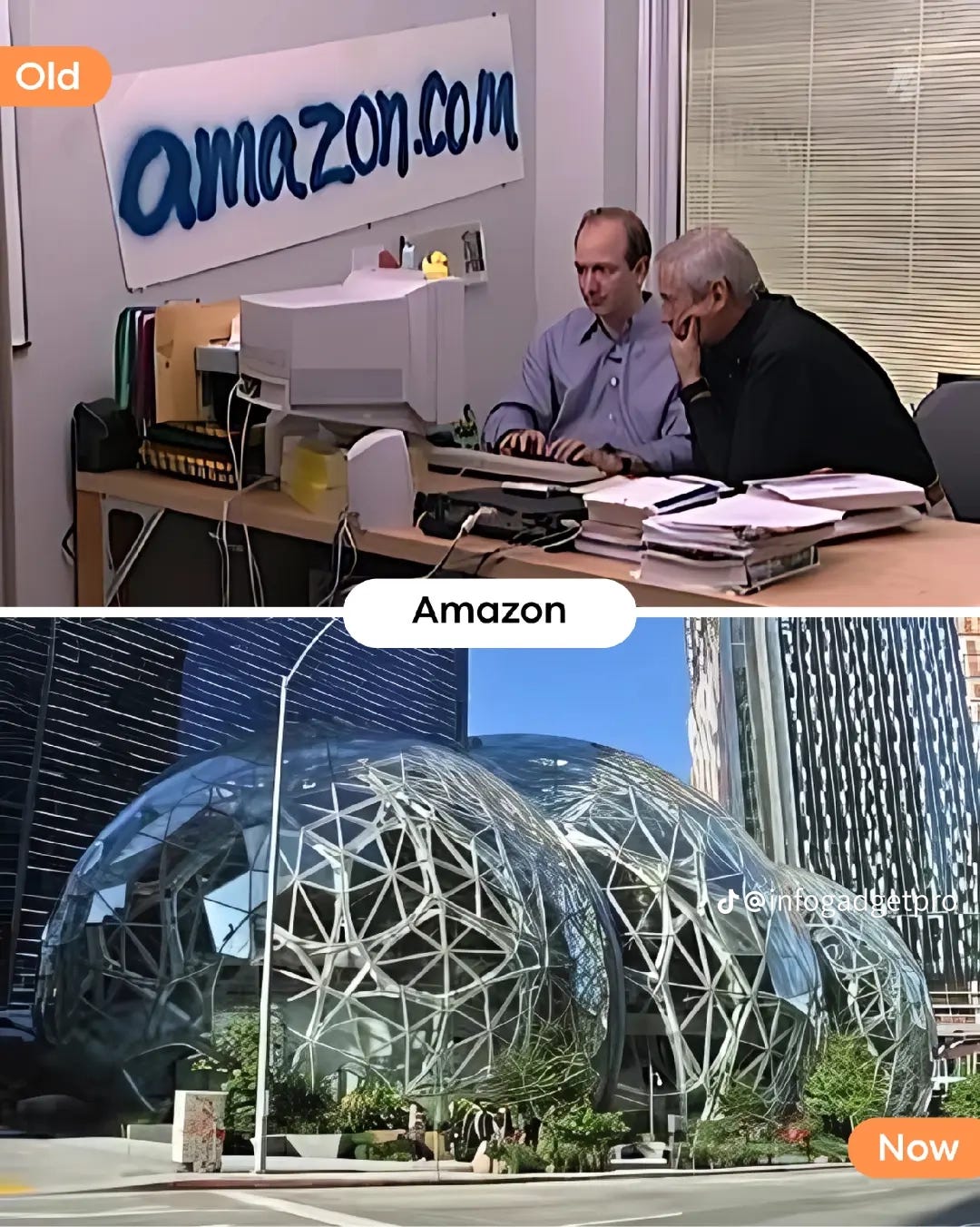

AMZN - Amazon.com Inc.

Entry Point (1997 IPO): $18 per share, $438M market cap

Current Position: $1.5T market cap (342,000% return)

The Catalyst: Bezos trading his Wall Street salary for a Bellevue garage, 1994

Key Insight: He saw e-commerce disruption while others saw "just books online"

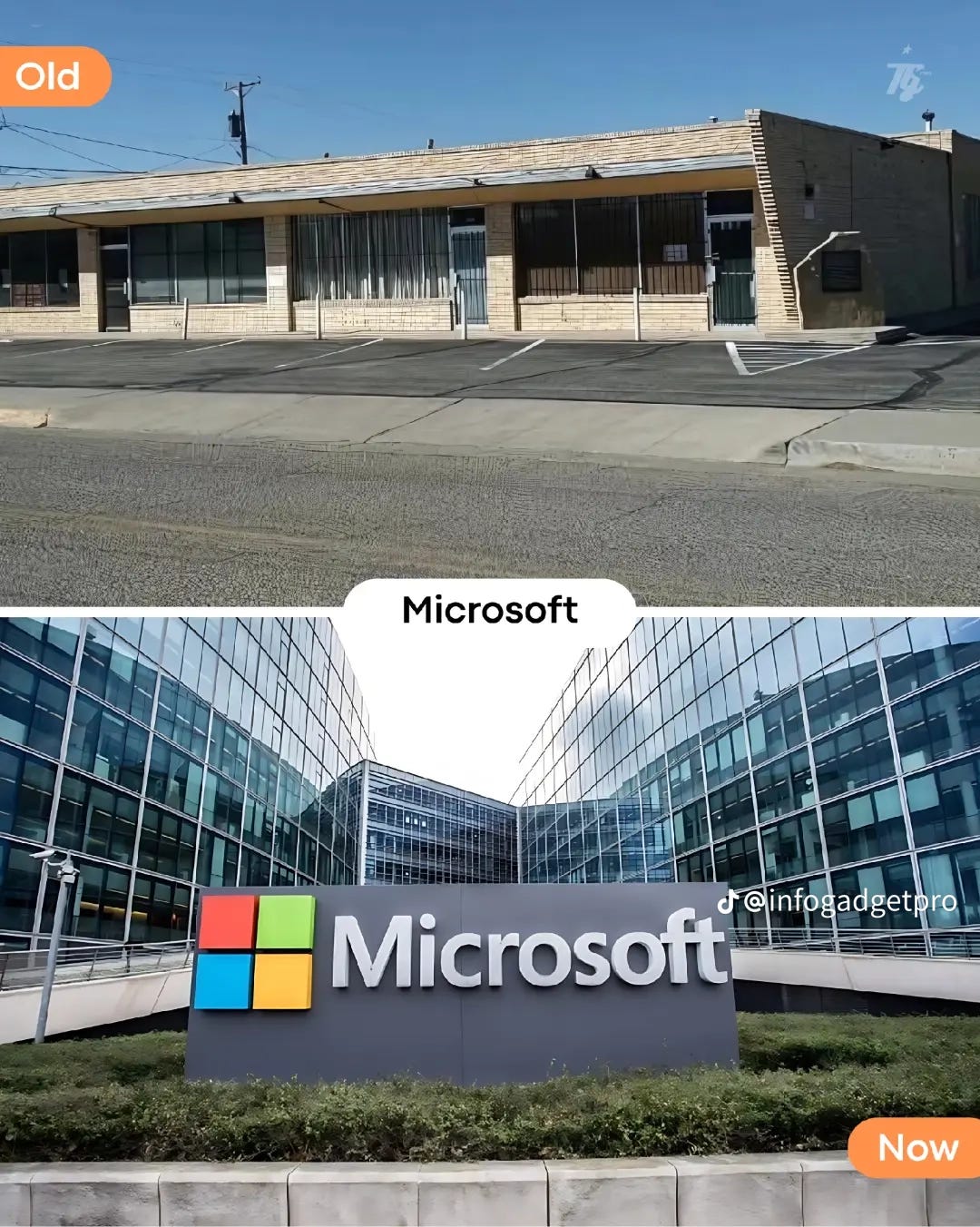

MSFT - Microsoft Corp.

Entry Point (1986 IPO): $21 per share, $777M market cap

Current Position: $3.1T market cap (399,000% return)

The Catalyst: Gates and Allen's Albuquerque office, 1975, betting on software licensing

Key Insight: They understood that software scales infinitely with zero marginal cost

META - Meta Platforms Inc.

Entry Point (2012 IPO): $38 per share, $104B market cap

Current Position: $800B market cap (669% return)

The Catalyst: Zuckerberg's Harvard dorm room, 2004, $1,000 server costs

Key Insight: Social graphs are more valuable than social networks

DELL - Dell Technologies Inc.

Entry Point: Multiple iterations, current cycle

Peak Valuation: $100B+ in various forms

The Catalyst: Michael Dell's UT dorm room, 1984, $1,000 startup capital

Key Insight: Direct-to-consumer model disrupts traditional distribution chains

DIS - The Walt Disney Company

Entry Point (Historical): Started 1957 on NYSE

Current Position: $180B market cap

The Catalyst: Walt and Roy Disney's uncle's garage, 1923, $500 borrowed capital

Key Insight: Intellectual property compounds like interest - Mickey Mouse still prints money 95 years later

HPQ - HP Inc. (Historical HPE split)

Entry Point (1957 IPO): One of the original tech IPOs

Legacy Value: Spawned the entire Silicon Valley ecosystem

The Catalyst: Hewlett and Packard's Palo Alto garage, 1939, $538 working capital

Key Insight: They created the venture capital playbook that funded everything that followed

The Pattern: What Every Trader Needs to Recognize

1. Asymmetric Risk Profile These weren't lottery tickets - they were calculated bets with limited downside and unlimited upside. Each founder risked small, defined amounts ($500-$1,300) for potentially infinite returns. Classic venture capital mathematics before venture capital existed.

2. Market Timing Wasn't the Edge None of these companies launched at "perfect" market moments. Apple launched during stagflation. Amazon during the dot-com crash fears. Microsoft during the PC industry infancy. The edge was seeing structural shifts before the market priced them in.

3. Moat Development Strategy Every single company built economic moats that competitors couldn't breach:

Apple: Ecosystem lock-in

Google: Data network effects

Amazon: Logistics infrastructure

Microsoft: Software switching costs

Meta: Social graph network effects

Disney: IP portfolio compounding

4. The Reinvestment Multiplier Each company plowed profits back into R&D and market expansion rather than early dividends. This created compound growth rates that traditional DCF models couldn't capture.

The Trader's Mindset Analysis

Here's what separates winning traders from the pack - they think like these founders:

Position Sizing Like a Pro These guys didn't bet the farm, but they bet enough to matter. Dell risked $1,000 he could afford to lose. Bezos invested $300K of family money with full risk disclosure. They sized positions for maximum asymmetric payoff.

Conviction + Flexibility Each founder had unwavering conviction about their core thesis but stayed flexible on execution. Jobs pivoted from computers to phones to tablets. Bezos went from books to everything to cloud computing. Strong opinions, loosely held.

Market Structure Understanding They didn't just pick stocks - they identified entire market structure shifts:

Personal computing (Apple, Microsoft, Dell)

Internet search monetization (Google)

E-commerce infrastructure (Amazon)

Social media advertising (Meta)

Entertainment IP (Disney)

Risk Management Through Diversification Look at their current portfolios - none stayed in their original lane. Amazon isn't just e-commerce (AWS, advertising). Google isn't just search (YouTube, Cloud, AI). They built diversified revenue streams within single tickers.

The Million-Dollar Question: What's Next?

If you can spot the next garage-to-giant pattern, you're looking at potential 10,000%+ returns over the next 20 years. The sectors showing similar early-stage signals:

AI/Machine Learning infrastructure

Renewable energy storage

Biotech/Longevity research

Space commercialization

Quantum computing

Decentralized finance protocols

Your Path to Trading Like the Legends

Here's the reality: You have access to the same tools, information, and opportunities that created these trillion-dollar empires. The difference isn't capital, connections, or luck - it's methodology.

Our 3-Step Swing Trading System That Targets Big Moves:

This is the exact methodology we use to identify and capitalize on major market moves across stocks, Forex, and crypto. The same system that helped us spot Tesla at $40, Bitcoin at $15K, and EUR/USD major reversals.

Step 1: Pattern Recognition

Identify structural market shifts before they become obvious

Spot high-probability setups using technical and fundamental confluence

Target assets showing early signs of major directional moves

Step 2: Risk-Reward Optimization

Calculate precise entry points with 3:1 minimum risk/reward ratios

Set strategic stop losses that protect capital while allowing for normal market noise

Position size based on account percentage and setup confidence level

Step 3: Trade Management

Scale into positions as momentum confirms our thesis

Take partial profits at predetermined targets

Trail stops to maximize big move captures while protecting gains

This is just the foundation of our approach. Our premium members get the complete playbook including:

Exact entry/exit signals with price targets and stop levels

Live trade alerts sent directly to your phone/email

Weekly market analysis covering our top setups across all markets

Position sizing calculators and risk management tools

Breakdowns of why we're taking each trade

But let's start with the basics that you can implement right now...

The Exact Setup We're Trading Right Now

Current Market Pattern Recognition: We're seeing the same garage-stage signals in:

AI Infrastructure (our highest conviction play)

Renewable Energy Storage (entering accumulation phase)

Space Economy (early institutional adoption)

Biotech/Longevity (breakthrough catalyst pending)

How We're Positioning:

40% AI and automation plays

25% renewable energy transition

20% next-generation consumer tech

15% biotech moonshots

Risk Management Rules We Never Break:

Max 5% in any single position

Stop losses at -25% (no exceptions)

Take partial profits at +100%

Reinvest profits into new pattern setups

This Week's Free Market Insights

What We're Teaching Our Community This Week: Ticker NIO 0.00%↑

Pattern recognition techniques used by the world's most successful investors

How to identify structural market shifts before they become obvious

Risk management strategies that protect capital while maximizing upside

Our premium members get exact setups with precise entry/exit points, but these foundational concepts are available to all our free followers.

What Our Premium Members Get:

🎯 Exact trade setups with precise entry/exit points across all markets

📱 Live trade alerts sent to your phone for high-probability setups

📊 Detailed position sizing and risk management for your account size

🎥 Trade breakdowns explaining our complete analysis process

💬 Direct access to our trading team for personalized guidance

🏆 Real-time performance tracking of all our recommendations

Our systematic approach to swing trading has helped thousands of traders identify major moves across stocks, Forex, and crypto markets.

Start Your Journey Today

Step 1: Follow for Free Get our weekly insights, learn our basic methodology, and see if our approach resonates with you. No commitment, just valuable education.

Step 2: Paper Trade Our Concepts

Apply what you learn from our free content using virtual money. Test our methods without risking capital.

Step 3: Consider Upgrading When Ready Once you see the value in our approach and want the complete system with exact entries/exits, consider joining our premium community.

Ready to Begin?

👉 Follow us for free weekly insights - Start learning our methodology at no cost

👉 Join 7,000+ traders who rely on our analysis to guide their decisions

👉 See why our premium members consistently outperform the market

Remember: The same pattern recognition that created Apple, Amazon, and Google fortunes is happening right now in stocks, Forex, and crypto. The question is whether you'll be positioned to capture these moves.

This week's homework: Study one of the 8 companies above and identify what early technical pattern you could have spotted. Then apply that same pattern recognition to current markets.

The next big move is forming. Will you be ready?

Disclaimer: Past performance doesn't guarantee future results, but pattern recognition and asymmetric risk management are timeless. The greatest traders don't just follow trends - they identify them before the market does.

Position: Long innovation, short conventional thinking.