The Secret Trading Calendar Banks Don't Want You to Know About

How I spotted next week's EUR/USD move using a free tool that 99% of traders ignore

Here's something that'll blow your mind: while most forex traders are staring at 5-minute charts trying to predict the next candle, professional traders are looking at something completely different. They're watching the calendar.

Not earnings calendars or economic data releases. I'm talking about seasonal patterns that repeat year after year with clockwork precision. Patterns so reliable that hedge funds build entire strategies around them.

"The market is a device for transferring money from the impatient to the patient." - Warren Buffett

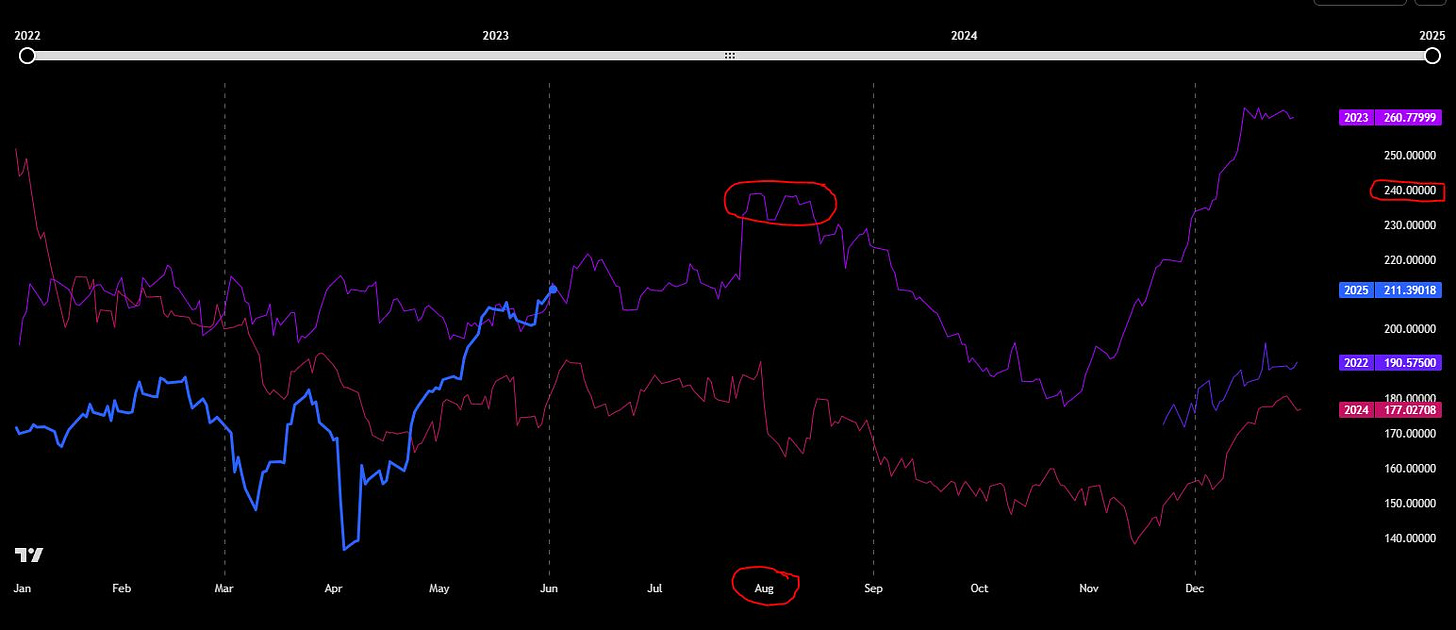

Last month, I watched traders panic sell EUR/USD during what looked like a massive breakdown. Meanwhile, the seasonality data was screaming "this is exactly what happens every October, and it reverses by mid November." Guess what happened two weeks later?

Today I'm going to show you how to use TradingView's seasonality tracker to spot these patterns before they unfold. More importantly, I'll teach you how to position yourself on the right side of moves that 90% of traders never see coming.

Why Forex Pairs Move Like Clockwork

The forex market isn't random. It's predictable in ways that most traders never discover.

Think about it logically. The global economy runs on cycles. Agricultural seasons drive commodity currencies. Holiday shopping affects consumer currencies. Central bank meeting schedules create predictable volatility windows. Tourism patterns shift money flows between countries.

These aren't small effects we're talking about. Some currency pairs show seasonal biases so strong they're right 70-80% of the time over multiple decades. That's not luck. That's mathematical edge disguised as calendar dates.

Key seasonal drivers include:

Keep reading with a 7-day free trial

Subscribe to Inside the Trade: to keep reading this post and get 7 days of free access to the full post archives.